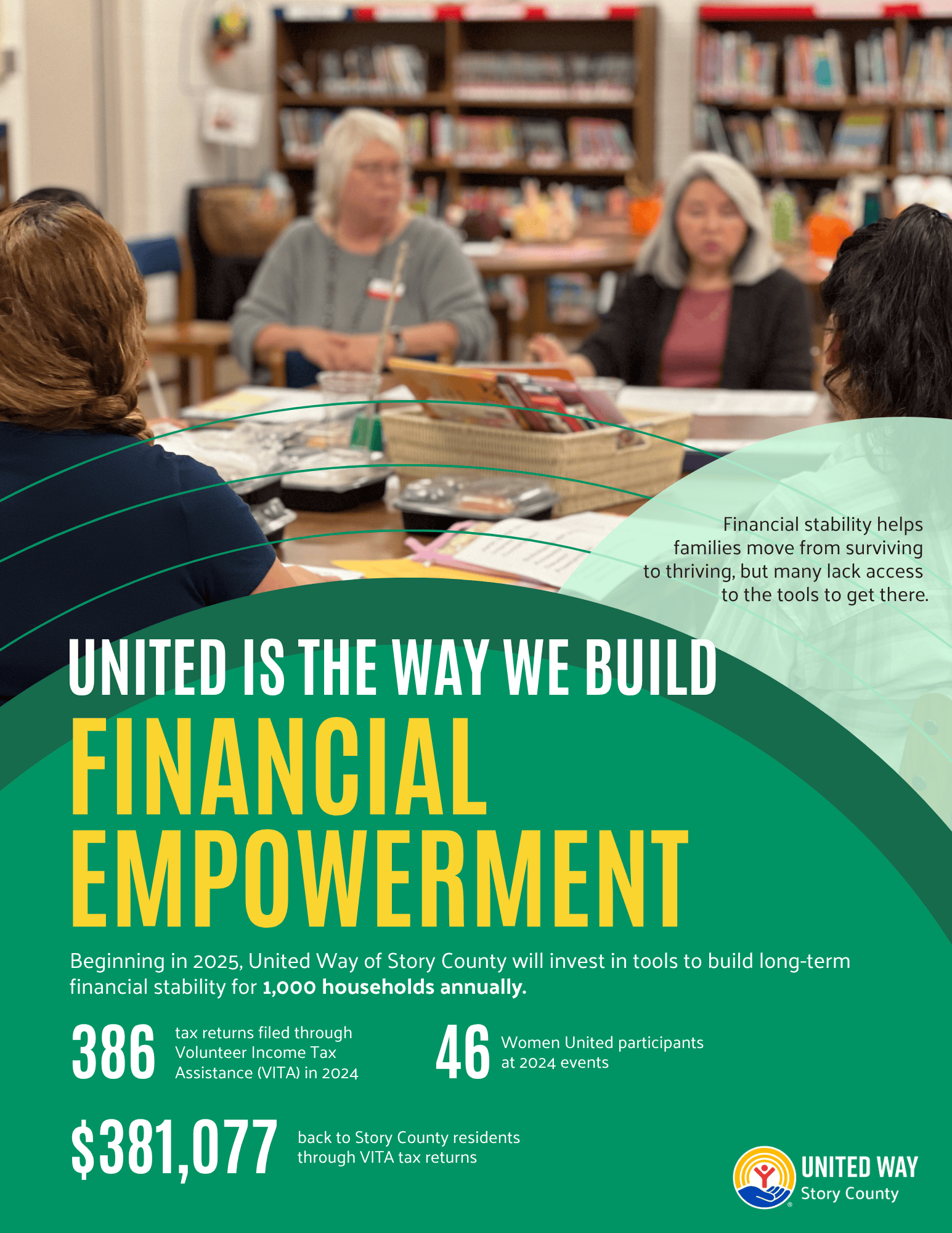

UNITED IS THE WAY WE BUILD FINANCIAL EMPOWERMENT

Thousands of Story County families aren’t in the financial position to weather even a small storm, struggling paycheck to paycheck.

Thousands of Story County families aren’t in the financial position to weather even a small storm, struggling paycheck to paycheck.

Financial stability helps families move from surviving to thriving, but many lack access to the tools to get there.

In 2024, our investments and programs supported:

- 386 tax returns were filed through the Volunteer Income Tax Assistance (VITA) program

- $381,077 came back to Story County residents through the VITA tax returns

- 46 people participate in Women United financial literacy events

Beginning in 2025, United Way of Story County will invest in tools to build long-term financial stability for 1,000 households annually through:

- Access to affordable, quality child care

- VITA volunteer recruitment and filings

- Women United

- Wheels for Work

FINANCIAL EMPOWERMENT IN STORY COUNTY

We work to make sure everyone has access to basic needs by creating programs and partnerships that tackle the specific challenges in our community. Our goal is to help every resident in Story County get the essential resources they need for a better quality of life.

NOTE: Data from 2019 or most recent year available. While these indicators are not the only ways to assess access to basic needs in our community, these are data points that illustrate that there is a need in our goal area.

Over 18,500 Story County residents live below the federal poverty level

- 19% of people experience severe housing challenges (defined as overcrowding, high housing costs, lack of kitchen facilities and/or lack of plumbing facilities)

- 51.1% of households spend 30% or more of income on rent

Help families and adults meet their basic needs

- Provide housing support

- Provide emergency services

- Ensure access to reliable transportation

- Grow knowledge of community resources to help meet basic needs

6,282 people referred to financial and non-food assistance programs

- 1,802 households received financial assistance to relieve housing cost burden and prevent homelessness

- 61,190 people served through food pantries and emergency food vouchers

- 1,049 individuals received transportation assistance

We aim to provide financial education for everyone by implementing effective programs and collaborating with local partners. Our goal is to help every person in Story County gain the knowledge and confidence to make informed financial decisions.

NOTE: Data from 2019 or most recent year available. While these indicators are not the only ways to assess financial education in our community, these are data points that illustrate that there is a need in our goal area.

41% of Iowans surveyed indicated it is difficult to cover expenses and pay all bills in a typical month

- 6% of Story County households have no savings or checking account

- 12% of households are underbanked

- 24% of households cannot survive for three months at the poverty level without any income

Increase financial capability among Story County residents

- Provide basic personal financial education and other financial programs

- Support access to banks’ financial services

- Increase financial opportunity

198 participants in financial literacy or financial assistance programs

- 92.9% of participants reported having increased financial knowledge

- 13 people reported having improved their income to expense ratio

- 35.8% reported a general improvement in their financial situation

LOCAL INVESTMENTS & INITIATIVES

Partner Agencies

These are our current Financial Empowerment partner agencies. Contact them directly to learn more about their services.

Indicators

Financial Security Indicator #1

Access to Basic Needs - LEARN MORE

Financial Security Indicator #2

Increasing Income - LEARN MORE

Financial Security Indicator #3

Increased Financial Capability - LEARN MORE