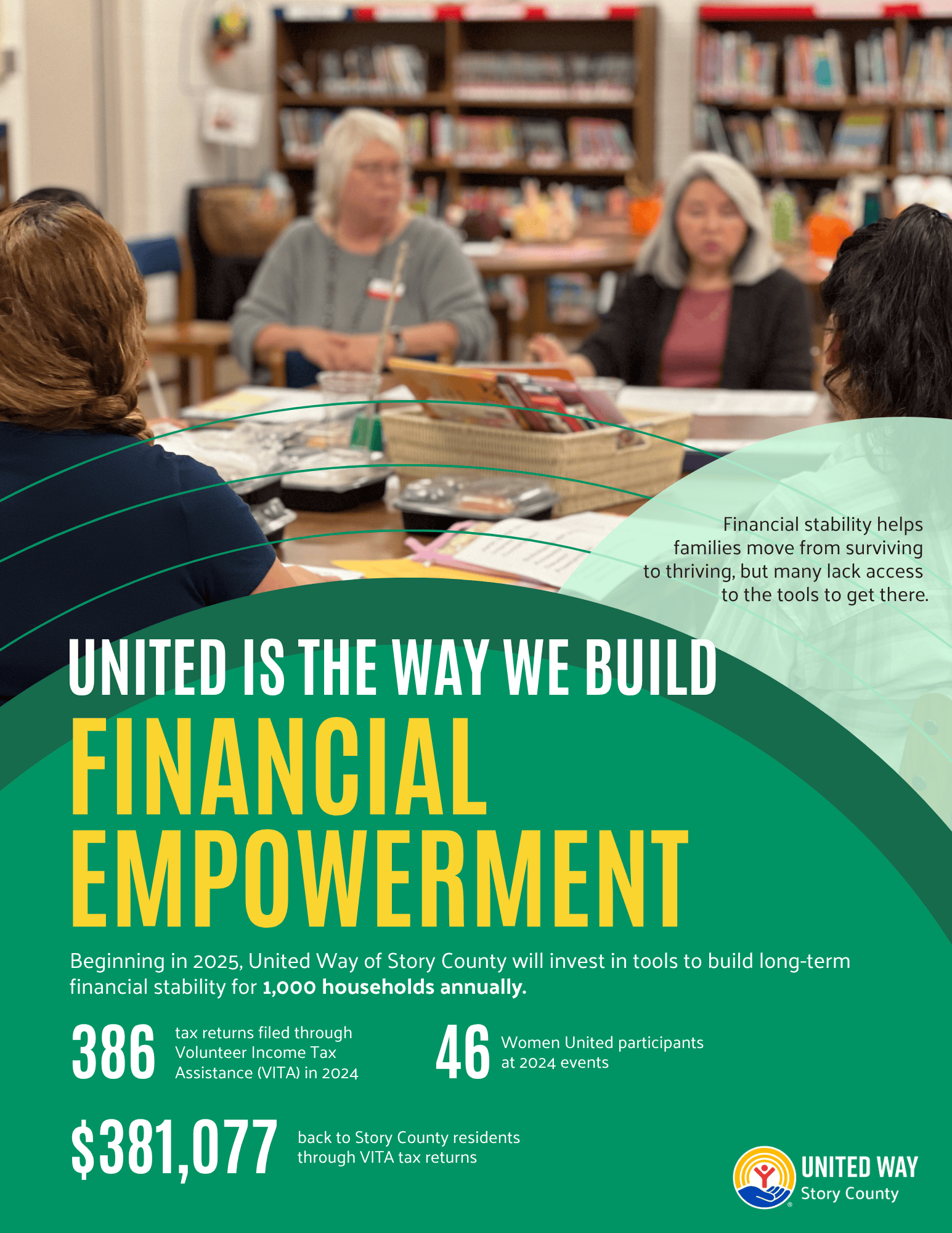

UNITED IS THE WAY WE BUILD FINANCIAL EMPOWERMENT

Thousands of Story County families aren’t in the financial position to weather even a small storm, struggling paycheck to paycheck.

Thousands of Story County families aren’t in the financial position to weather even a small storm, struggling paycheck to paycheck.

Financial stability helps families move from surviving to thriving, but many lack access to the tools to get there.

In 2024, our investments and programs supported:

- 386 tax returns were filed through the Volunteer Income Tax Assistance (VITA) program

- $381,077 came back to Story County residents through the VITA tax returns

- 46 people participate in Women United financial literacy events

Beginning in 2025, United Way of Story County will invest in tools to build long-term financial stability for 1,000 households annually through:

- Access to affordable, quality child care

- VITA volunteer recruitment and filings

- Women United

- Wheels for Work

FINANCIAL EMPOWERMENT IN STORY COUNTY

We aim to provide financial education for everyone by implementing effective programs and collaborating with local partners. Our goal is to help every person in Story County gain the knowledge and confidence to make informed financial decisions.

NOTE: Data from 2023 or most recent year available. While these indicators are not the only ways to assess financial education in our community, these are data points that illustrate that there is a need in our goal area.

Financial insecurity affects thousands of households in our community, as shown by these realities:

- 18% of households are unbanked or underbanked

- 26% of households do not have $400 on hand to cover an emergency expense

- 34% of people reported worrying about rent/mortgage over the last year

- 51% of households spend 30% or more of income on rent

Invest in programs that provide financial tools, education, and support to help families build long-term stability including:

- Quality, affordable childcare

- Income tax preparation assistance (VITA)

- Financial education programming and financial coaching

- Support services for homelessness prevention and housing navigation

These strategic investments deliver tangible outcomes for Story County households:

- 395 individuals filed taxes at community VITA sites

- 8,127 individuals referred to financial assistance and other non-food programs to increase their disposible income

- $1,380.71 was the average tax return for VITA filers

- 243 people participated in financial literacy or financial assistance programs

- 94% of financial literacy/financial assistance program participants reported having increased financial knowledge

- $14,264 saved through SingleCare prescription cost-savings cards

LOCAL INVESTMENTS & INITIATIVES

Partner Agencies

These are our current Financial Empowerment partner agencies. Contact them directly to learn more about their services.