United Way of Story County takes the role as a trusted community leader very seriously. UWSC has a long and proud tradition of high standards of accountability.

UWSC has a stringent system of checks and balances to make certain operations are in sound fiscal shape. The operating budget and community funding decisions are reviewed and approved by volunteer committees, including the Board of Directors. Independent CPA firm Schnurr and Company conducts the annual audit, which is then reviewed by the volunteer Executive Committee and approved by the Board of Directors. UWSC follows the American Institute of Certified Public Accountants Audit and Accounting Guide for Not-for-Profit Organizations to ensure financial statements conform with Generally Accepted Accounting Principles. Information about how donations are used is openly provided and questions are welcomed regarding these topics.

United Way Worldwide's membership requirements, since their approval in 1999, have included basic standards for United Way's financial accountability. Specifically, United Way's shall:

- Be recognized as exempt from taxation under Section 501(c)(3) of the Internal Revenue Code as well as from corresponding provisions of other applicable state, local or foreign laws or regulations and file IRS Form 990 annually in a timely manner.

- Have an annual audit conducted by an independent certified public accountant whose examination complies with generally accepted accounting standards and GAAP. In addition to the audit, we also provide an annual report.

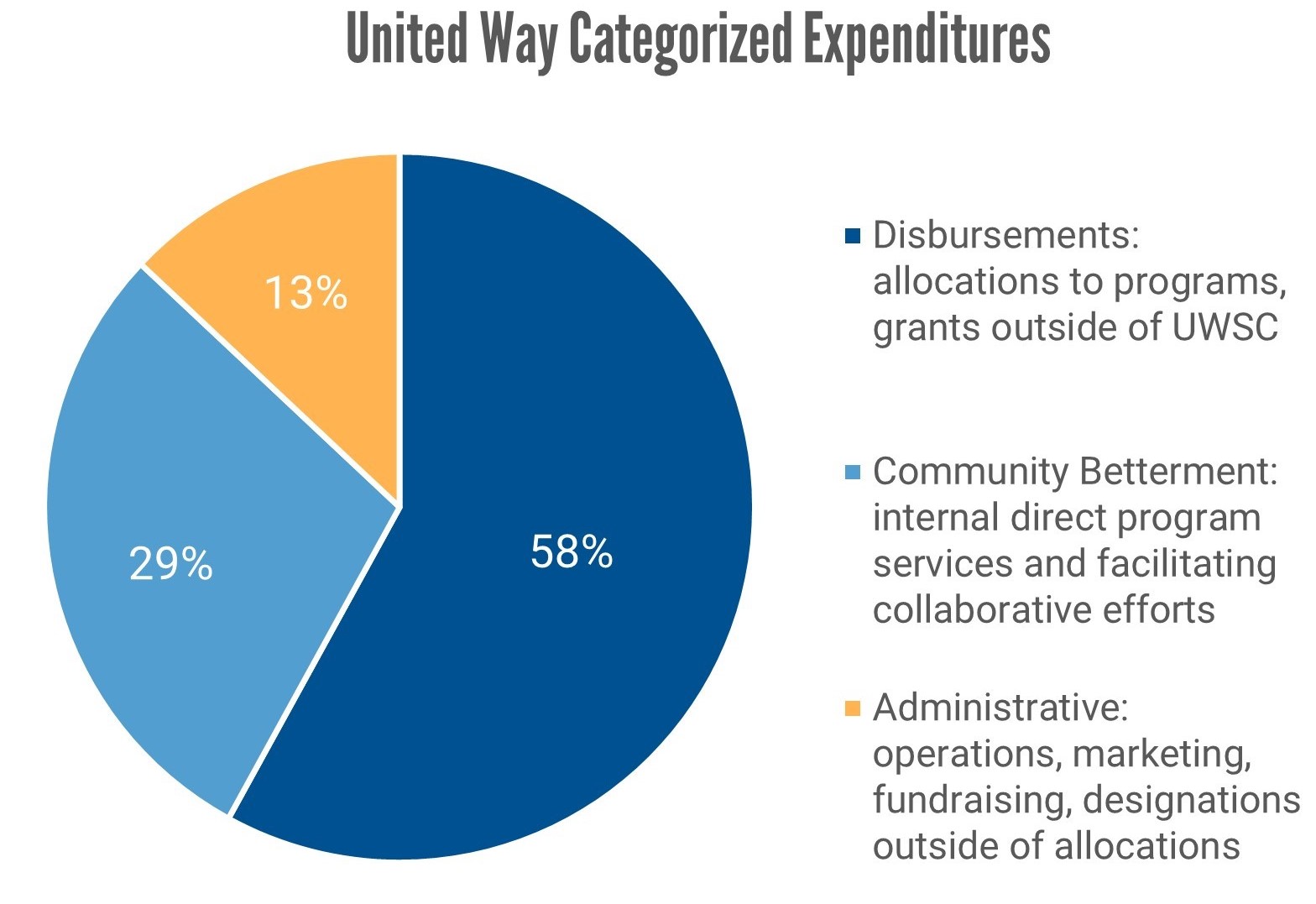

Disbursements are made in the areas of health, education, and financial stability. These could be allocations through ASSET to fund nearly 90 core programs at our 32 partner agencies or grants to partner agencies and other groups working in these areas. Grants are reviewed by the allocations committee on a regular basis throughout the year.

Community betterment includes United Way’s community impact work and flagship programs like Women United and Wheels for Work, as examples, and also the collaborations like Story County Reads, Analysis of Social Services Team (ASSET), Coalition for Disaster Recovery, Food Pantry Collaboration, Hunger Collaboration, Mental Health/Criminal Justice Task Force, Transportation Collaboration, Story County Alliance for Philanthropy, and Story County Quality of Life Alliance.

Administrative rates vary at local United Ways. United Way of Story County’s information is seen in the above chart. The U.S. United Way network’s administration/overhead is very competitive with the nation's top 100 nonprofits. Both the U.S. United Way network and United Way of Story County’s administrative rates are well below industry standards and recommendations (like the Better Business Bureau Wise Giving Alliance at 35% and the Office of Personnel Management/OPM at 25%). United Way of Story County and other local United Ways play a role in helping hundreds of other nonprofits maintain efficiency and lower administrative rates of their own. During FY2018 UWSC received grant funds that were paid out directly to other programs and services. These grant opportunities were not repeated at the same level in FY2019, therefore to remain consistent with previous years administrative fee charged for campaign designations the board of directors set this rate at 15.31% which is lower than the 15.46% in previous years.

United Way of Story County has received the highest external ratings from multiple sources. Please view our profiles on Charity Navigator and Guidestar.

-

United Way of Story County Charity Navigator Rating = 100/100 with a 4 Star Rating (highest rating)

-

United Way of Story County Guidestar Rating = Platinum Level (highest rating)